Trong bài IELTS Writing Task 1 Academic, có tới 40% số biểu đồ có chứa thông tin ở tương lai. Vì thế cấu trúc dự đoán prediction là cực kỳ quan trọng cho bài viết band 7+. Bài học này sẽ hướng dẫn bạn từng bước về cấu trúc dự đoán tương lai và ứng dụng thực tế vào bài viết kèm theo bài tập.

Nếu bạn còn chưa hiểu rõ về IELTS Writing Task 1. Bạn có thể học ngay chương trình học Ultimate Guide on IELTS Writing Task 1 hoàn toàn miễn phí mà chi tiết để có thể giúp bạn có các kiến thức đầy đủ nhất cho IELTS Writing Task 1.

NÓI VỀ TƯƠNG LAI TRONG IELTS WRITING TASK 1 ACADEMIC KHÔNG ĐƠN GIẢN

Thực ra, rất nhiều bạn học sinh của tôi tại các lớp IELTS Online hay thậm chí IELTS Writing Advanced cũng đều nghĩ rằng:

“Trong IELTS Writing Task 1, nếu cứ gặp thông tin ở tương lai thì cứ đơn giản là dùng ‘will’ thôi chứ có gì đâu.”

Nhưng, thực tế lại là bạn không thể chỉ nói điều gì đó là will happen. Bạn chỉ có thể dự đoán rằng nó có thể xảy ra chứ không phải sẽ xảy ra. Tức là bạn chỉ có thể dùng ‘may’ hoặc ‘could’.

Tuy thế, modal verbs như may hay could lại thiếu rõ ràng, không chắc chắn, (và theo một giám khảo nói với tôi thì modal verbs này mang yếu tố chủ quan mà chúng ta lại cần phải khách quan).

Đó chính là lí do tôi hướng dẫn các bạn về cấu trúc dự đoán, cấu trúc dự báo tương lai trong IELTS Writing Task 1.

Trước khi đọc tiếp bài học ở bên dưới, bạn có thể đăng ký để nhận email hàng tuần của tôi. Tôi sẽ gửi bạn những nội dung, tips, hướng dẫn, kinh nghiệm giúp bạn học tiếng Anh và IELTS hiệu quả nhất nhé. Có rất nhiều tài liệu và bài học độc quyền tôi chỉ gửi qua email này thôi đấy. (Nếu bạn đã đăng ký, vui lòng bỏ qua nhé. Rất xin lỗi đã làm phiền bạn)

CẤU TRÚC DỰ ĐOÁN TƯƠNG LAI PREDICTION TRONG IELTS WRITING TASK 1 ACADEMIC

Để nói về sự dự đoán trong tương lai thì chúng ta có thể sử dụng cấu trúc:

It is predicted/forecast/expected/suggested/likely that

Trong đó bạn lưu ý là cấu trúc sau được ưa chuộng hơn, đó là: it is predicted that … và it is likely that …

Và nhớ là sau that là một mệnh đề đầy đủ nhé.

Và khi bạn sử dụng cấu trúc này thì ở mệnh đề sau that, bạn sẽ có thể sử dụng will rồi nhé.

Ví dụ:

It is predicted that the population will increase to 8 billion at the end of this century.

Một cấu trúc khác bạn cũng có thể sử dụng đó là:

… is expected/forecasted/predicted

Ví dụ:

An increase in the population to 8 billion is predicted at the end of this century.

Bên cạnh đó bạn có thể nói rằng:

Over the period of prediction, the population will increase to 8 billion.

(Với điều kiện là giai đoạn dự đoán period of prediction là trùng với thời gian bạn muốn nói nhé).

VÍ DỤ VỀ CẤU TRÚC DỰ ĐOÁN TRONG BÀI IELTS WRITING TASK 1

Ở đây mình lấy một bài ví dụ (rất điển hình) về cấu trúc dự đoán và áp dụng vào trong bài viết mẫu nhé. Bạn hãy phân tích đề, sau đó xem 2 bài mẫu ở dưới và các cấu trúc dự đoán đã được highlighted rồi nhé.

You should spend about 20 minutes on this task.

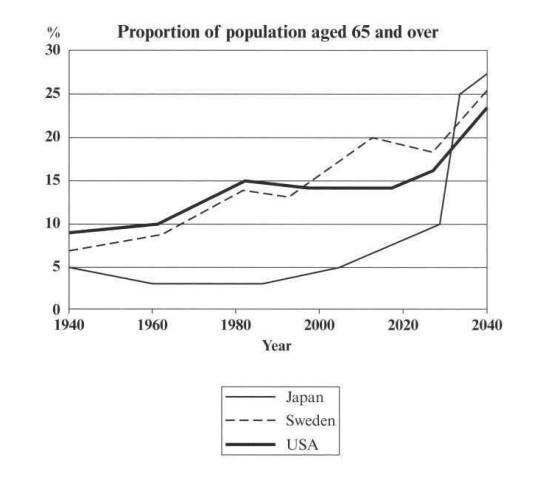

The graph below shows the proportion of the population aged 65 and over between 1940 and 2040 in three different countries.

Summarise the information by selecting and reporting the main features, and make comparison where relevant.

Write at least 150 words.

Sample answer

Since 2000, Swedish population is predicted to be older than American population and probably continue to increase in the next 40 years. However, the proportion of older people in Japan is predicted to dramatically rise from 2030, and Japanese population will become the oldest among 3 countries in the late 2030. In 2040, it is thought that the proportion of the population aged 65 and more in these countries will be similar at around 25%.

Another sample answer

From 2000, it is predicted that Swedish population will become older than American, and Japanese aged population will suddenly boom and will become oldest among 3 countries. In 2040, people aged 65 and over accounted for a quarter of total population in 3 countries.

LƯU Ý!

Cảm ơn bạn đã đọc bài viết này. Mình rất mong bạn dành vài giây để đọc thông tin này nhé.

Lớp học tiếng Anh mất gốc Online English Boost sắp khai giảng giúp bạn lấy lại tự tin trước khi học IELTS, hãy nhanh tay đăng ký nhé.

Nếu bạn đang học IELTS Writing nhưng mãi chưa viết được bài hoàn chỉnh hoặc mãi chưa tăng điểm. Đó là do bạn không có người hướng dẫn chi tiết và không được chữa bài, hãy đăng ký khóa học IELTS Online Writing 1-1 với đặc trưng là tất cả bài viết đều được chữa chi tiết nhiều lần bởi giáo viên và cựu giám khảo, đã giúp tăng 0.5 chấm trong 2 tuần.

Nếu bạn đang gặp khó khăn khi bắt đầu việc học IELTS 4 kỹ năng đừng tự mò mẫm nữa. Để tiết kiệm thời gian và chi phí, bạn có thể đăng ký ngay khóa học IELTS Online Completion 4 kỹ năng để học từ cơ bản tới nâng cao, với chi phí thấp, có tương tác trực tiếp rất nhiều với giáo viên, đã giúp rất nhiều bạn đạt 6.5 – 8.0 chỉ với chi phí cực ít.

Nếu bạn đang luyện thi IELTS Speaking và Writing mà gặp khó khăn với từ vựng do quá nhiều chủ đề và quá nhiều từ vựng cần học. Nếu bạn không biết nên ôn Reading và Listening thế nào. Bạn nên sử dụng bộ đề IELTS Dự Đoán Mỳ Ăn Liền có kèm đáp án chi tiết đầy đủ cũng như các giới hạn đề thi. Đề cập nhật thường xuyên giúp bạn ôn thi tốt hơn.

Cảm ơn bạn đã dành thời gian xem thông tin.

BÀI TẬP CẤU TRÚC DỰ BÁO TƯƠNG LAI PREDICTION

Các bạn viết bài viết dưới đây để áp dụng các kiến thức về cấu trúc dự báo tương lai nhé. Sau đó comment vào bên dưới nhé.

Các bạn học sinh các lớp IELTS Online và IELTS Writing Online làm bài nghiêm túc bằng cách comment ở dưới để giáo viên theo dõi tiến bộ và có feedback phù hợp cho lộ trình học.

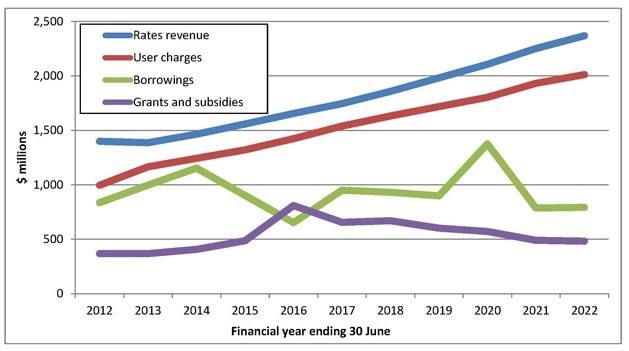

You should spend about 20 minutes on this task.

The line graph shows the past and projected finances for a local authority in New Zealand.

Summarize the information by selecting and reporting the main features and make comparisons where relevant.

Write at least 150 words.